Major League Baseball posted another year of solid revenue growth, which contributed to steadily increasing franchise enterprise value, but operating profit took a downturn as teams increased investment in player development, marketing and analytics, according to the latest Forbes survey of the game’s financial landscape.

MLB Financial Snapshot, 2003-2017

Note: Revenue for each team is net of stadium debt and revenue sharing, and includes non-MLB events at the ballpark. Also excluded was the $18 million payout to each team from the sale of BamTech to Disney as well as profit/loss from RSNs in which teams own equity.

Source: Forbes.com

League-wide, net revenue was up 5%, with four teams pulling up the average. The Braves, at 22%, parlayed their new ballpark into the largest increase, while the Yankees, Astros and Dodgers benefited from deep postseason runs that inflated their top line. Meanwhile, only five teams recorded a lower revenue figure in 2017, with most of the league registering between flat and 7% growth.

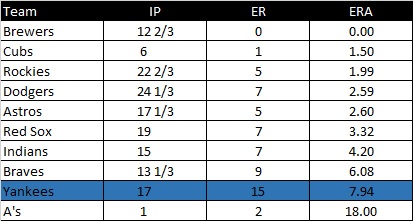

Although revenues were up broadly, the bottom line wasn’t as robust. Two-thirds of the league saw their operating profit take a dip, including several substantial declines. The Marlins’ $50 million operating loss was both the largest overall figure and year-over-year decline, but four other teams also saw profits decline by over $20 million. Included in that group was the Yankees, who, despite taking in nearly $100 million more in revenue, saw EBITDA drop by $25 million, a margin decline of over 500 basis points. The opposite was true for the Dodgers, who reigned in their spending, enabling nearly every penny of the team’s increased revenue to flow through to the bottom line. Other teams enjoying a healthy profit spike were the Braves, Cubs and Rangers.

Despite the over 16% decline in league-wide operating profit, all but six teams remained in the black, with only the Marlins, Tigers, Orioles and Royals reporting substantial losses. The general health of the league contributed to a 7% rise in franchise values, which ranged from a 1% increase for the Pirates to 16% for the Athletics.

Top-5 and Bottom-5 Teams by Valuation, Net Revenue, EBITDA – 2017

Note: Revenue/EBITDA for each team is net of stadium debt and revenue sharing, and includes non-MLB events at the ballpark. Also excluded was the $18 million payout to each team from the sale of BamTech to Disney as well as profit/loss from RSNs in which teams own equity. Franchise values are enterprise value (equity – net debt).

Source: Forbes.com

A hot topic during the off season was the degree to which the players have been sharing in MLB’s consistent revenue growth. Based on Forbes’ revenue figures, total compensation, which increased by 4% in 2017, remained just above 50% despite losing 30 basis points. However, these figures do not include investments made in player development initiatives and non-40 man salaries, which Forbes cited as a reason for the decline in operating profit.

MLB Player Compensation vs. League Revenue

Notes: Data Labels represent “year over year comp growth / total comp as percentge of net revenue”. Revenue is net of stadium debt service. Total compensation is actual payroll + player benefit costs + players’ share of the postseason revenue pool. For pre-2015, benefit costs were determined by working backward from the known 2015 amount and assuming a 4% growth rate (CBA calls for increases up to 10%).

Source: MLB releases published by AP (actual payroll), baseball-almanac (postseason revenue) and Forbes (net revenue)

While the players’ share of revenue was stable in aggregate, each team’s level of investment was varied. The Tigers were the biggest relative spenders, allocating over 70% of revenue to player costs. Of course, that helps explain the team’s substantial operating deficit. In fact, all six teams that reported EBITDA losses also invested in player costs at a percentage well above the league average. The more profitable teams, however, did not follow a pattern. The Dodgers and Cardinals, for example, spent above the league average, but were highly profitable, while teams like the Phillies and Brewers were rewarded for their thrift. Notably, both teams, along with the Padres, were among the more aggressive spenders this past off season, so at least some of their largess has already been put to good use.

2017 Player Cost (Payroll/Luxury Tax) as a Percentage of Team Revenue for all 30 Teams

Note: Red shading indicates teams with an operating loss (EBITDA).

Revenue/EBITDA for each team is net of stadium debt and revenue sharing, and includes non-MLB events at the ballpark. Also excluded was the $18 million payout to each team from the sale of BamTech to Disney as well as profit/loss from RSNs in which teams own equity. Payroll excludes benefits and is based on final figures for each year released by MLB, and may not necessarily equal the amount upon which the luxury tax is based.

Source: MLB releases published by AP (final payroll), MLB releases published by AP (luxury tax) and Forbes (revenue)

MLB’s ever increasing franchise valuations speak to the underlying strength of the baseball business. This has made owning a baseball team more than just a vanity purchase…it’s now a pretty good investment. And, though it speaks to the health of the industry, that’s not necessarily a good thing. Instead of wasting time and energy worrying about pace of play, Commissioner Rob Manfred should be keen on ensuring that baseball owners don’t completely divorce the importance of winning games from their increasingly voracious profit motive. Winning at any cost may have gone out of style with the passing of George Steinbrenner, but profit at any loss should not be accepted as a reasonable alternative.

Footnotes

Forbes’ revenue figures differ from totals reported by MLB because they include ancillary stadium revenue (such as concerts and other sporting events), but exclude applicable stadium debt payments.

Forbes uses EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) as a measurement of operating income. Although usually defined as EBIT, Forbes not only adds back interest and taxes, but depreciation and amortization expenses as well. As a result, Forbes operating profit can appear higher than stated figures.