Hal Steinbrenner recently confirmed his intention to lower the Yankees’ payroll below the luxury tax threshold in 2014, setting off a flurry of reaction from the mainstream media and blogs alike. Aside from the simple irony of the Yankees adhering to a budget, the response has mostly centered on either the sacrifices the team must make to achieve its objective or the tricks that might be used to circumvent the spirit of the rule. And, in just about every analysis, the same premise has been applied: the Yankees’ new cost conscious approach is the result of the recently ratified CBA.

Since Steinbrenner’s comments, which were really nothing more than confirmation of what the team had been privately telling reporters, several members of the organization have made remarks implying that the Yankees’ budget tightening is a direct result of the new CBA. But, are these changes enough to justify the Yankees’ pending frugality, and just how much can the team really hope to save?

From a business perspective, we have no choice. Do you want to go over $1 million at the expense of an additional $50 million?” – Brian Cashman, quoted by CBS Sports, March 10, 2012

If the Yankees can benefit to the tune of $50 million, it’s hard to argue with the team’s desire to trim payroll. However, is it a realistic figure? In order to determine the validity of the claim, we first need to identify the sources of the potentials savings.

Luxury Tax

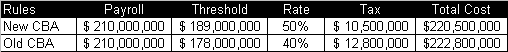

The most transparent way for the Yankees to benefit from the new CBA is to avoid paying the luxury tax, which, under the new rules, would be assessed at a top rate of 50% for frequent offenders (i.e., four or more consecutive seasons). Offsetting this more punitive rate, however, is a provision that resets the tax penalty to 17.5% once a team falls below the cut off. In this manner, the new CBA is using both a carrot and a stick to compel teams to avoid spending above the luxury cap.

Yankees’ Payroll vs. Luxury Tax Threshold and Total Tax Paid, 2003-2011

Source: bizofbaseball.com (tax and threshold) and Cot’s Contracts (Opening Day Payroll)

The reason the Yankees’ cost cutting measures have been targeted for 2014 is because the tax threshold will increase from $178 million to $189 million, making the plan more feasible. Of course, because the barrier is being lifted, the Yankees will enjoy an instant benefit, regardless of the actions they take to trim payroll. In fact, if the team maintained a $210 million payroll that was taxed at the maximum rate of 50%, the resultant $10.5 million tax bill in 2014 would be the lowest incurred since the current mechanism was instituted in 2002 (there was a different luxury tax structure used from 1997 to 1999, but that system was allowed to expire). In other words, there is nothing about the new luxury tax system compelling the Yankees to tighten their belt. In fact, the benefit of the increasing threshold more than cancels other the cost of the higher tax rate (see exhibit below).

Luxury Tax Comparison: Old CBA vs. New CBA (2014-2016)

Source: Proprietary calculation

Source: Proprietary calculation

Revenue Sharing Rebates

Obviously, the Yankees have bigger fish to fry than simply lowering their luxury tax…much bigger. Overlooked until recently, the new CBA also includes revised revenue sharing guidelines, the most significant being a rule prohibiting large market teams from receiving a payout. Under the old system, teams in large metropolitan areas were eligible to receive revenue sharing funds if their own in-take was lacking. The new CBA effectively puts a halt to this reward for under-earning teams by refunding the proceeds that would otherwise have been paid to them. That’s good news for the Yankees, who are believed to contribute well over $100 million per year in revenue sharing. However, there is one catch. In order to be eligible for the entire refund, a team may not be over the salary cap threshold for two consecutive seasons.

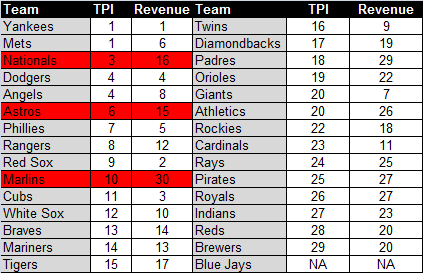

Unfortunately, the new CBA has not yet been released to the public. As a result, it’s impossible to accurately analyze the impact of the new revenue sharing rules. What we do know is if the Yankees’ implied expectation of a $40 million rebate is accurate, it will come at the expense of several large market teams, who would be forced to forfeit their cut of the pie when the new provision takes effect in 2016, according to the official summary available on MLB.com.

Market Total Personal Income (TPI) vs. Revenue, 2010 Rankings

Note: TPI is a measure that adds up a market’s total income. For markets with two teams, the TPI was divided by two.

Source: forbes.com (revenue) and bizjournals.com (TPI)

Based on a comparison of a team’s 2010 revenue to its market’s total personal income (TPI), there are four candidates who could be impacted by the new large-market restrictions: Washington Nationals, Houston Astros, Miami Marlines, and Toronto Blue Jays (TPI was not available for Toronto, so this assumption was made based on the city’s metro population of over five million). However, with baseball’s revenue landscape being reshaped by lucrative media deals, these clubs may be in a different position by 2016 (the Marlins could also see a revenue boost from their new stadium, which will open in 2012). Assuming these larger market clubs see revenue increases on par with their market sizes (something made more likely by a revenue structure increasingly tied to local television contracts), there may not be much revenue sharing money to refund in 2016. If so, the Yankees’ forecast of a $40 million savings would be greatly exaggerated.

Even if the Yankees’ estimates are on the mark, it doesn’t explain why the team needs to dip below the $189 million ceiling by 2014. As demonstrated above, the luxury tax savings is insignificant relative to past seasons. So, if the team’s austerity program is really geared toward the revenue sharing portion of the savings, why isn’t the target year 2016? Unfortunately, no one has asked that question…yet.

There are many unanswered questions regarding how the Yankees will operate under the new CBA. In addition to the issues outlined above, there is also the matter of whether the Yankees’ intention is to temporarily dip below the threshold in order to reset the luxury tax rate and qualify for a revenue sharing rebate in 2016, or remain below the $189 million figure for the duration of the CBA and beyond? If the answer is the latter, Yankees fans may not be too happy, especially because the general assumption seems to be the team will re-deploy the expected windfall in subsequent seasons.

Wins and losses are all that really matters, so if the Yankees continue to field a championship caliber team, the fans will be happy. That’s why the organization’s plan for 2014 isn’t nearly as important as its roadmap for the years to follow. As Hal Steinbrenner recently stated, “you don’t need a $220 million payroll [to win]”, but fans probably won’t accept losing with a payroll below $189 million. The Yankees are well within their right to be concerned about the bottom line, but nothing flows through to the balance sheet more than the brand equity associated with a perennial winner. That’s something the franchise will have to consider as it tries to walk the tightrope between being penny wise and pound foolish.

Nice article.

I have a couple of points though.

1) Apparently Miami isn’t considered a top 15 market. Oakland is considered a top 15 market, but is exempt from the new rule until their stadium situation is resolved. ESPN had the team list here: http://espn.go.com/mlb/story/_/id/7272337/details-baseball-new-labor-deal

2) 2016 is when the affected teams would lose 100% of their revenue sharing, but rebates start earlier. Affected teams lose 25% of their revenue sharing in 2013, 50% in 2014, and 75% in 2015. The Yankees would seem to stand to get a revenue sharing rebate in 2014, but obviously not as big as they likely would receive later. The ESPN link mentions teams have to be under for 2014 to receive rebates, but its not clear if they have to stay under for 2014 to receive future rebates of just 2014 rebates. The MLB release says teams exceeding 2 or more consecutive times will forfeit some or all of their refund, so perhaps getting under for 2014 ensures bigger refunds in later years.

Like you said, we’ll have to wait for the new CBA to be released to figure out the details.

Thanks for providing a link to the that AP article. I couldn’t find more details on the programs, which makes me wonder where they got that info. I really wish the two sides would release a ratified CBA to we can be sure about the details.

The most interesting thing about the AP link is the implication that 2012 and 2013 refunds will accumulate until after 2014, at which point they would paid out, or at least I think that’s what it says.

Ultimately, however, I think the most important element is the market size. The TPI formula I used and the AP list both identify similar teams, except Oakland, which gets an exception. If I didn’t divide TPI by 2, Oakland would have crept up on my list, but I guess MLB doesn’t allow for that mitigation.

[…] Despite winning 97 games with a makeshift rotation in 2011, the Yankees entered the winter with a glaring need in the rotation. In the past, the team probably would have pursued veteran free agents like C.J. Wilson and Mark Buehrle, but this offseason, the team did not spend like your father’s Yankees, or more aptly, Hal’s father’s Yankees. Instead, Brian Cashman was instructed to begin laying the groundwork for a reduced payroll that would see the team fall below the luxury tax threshold by 2014. […]

[…] to keep track of the team’s 2014 obligations. Furthermore, I highly recommend reading this article explaining what’s at stake if the Yankees fail to meet the $189M threshold in 2014. […]

[…] to keep track of the team’s 2014 obligations. Furthermore, I highly recommend reading this article explaining what’s at stake if the Yankees fail to meet the $189M threshold in 2014.Lastly, […]